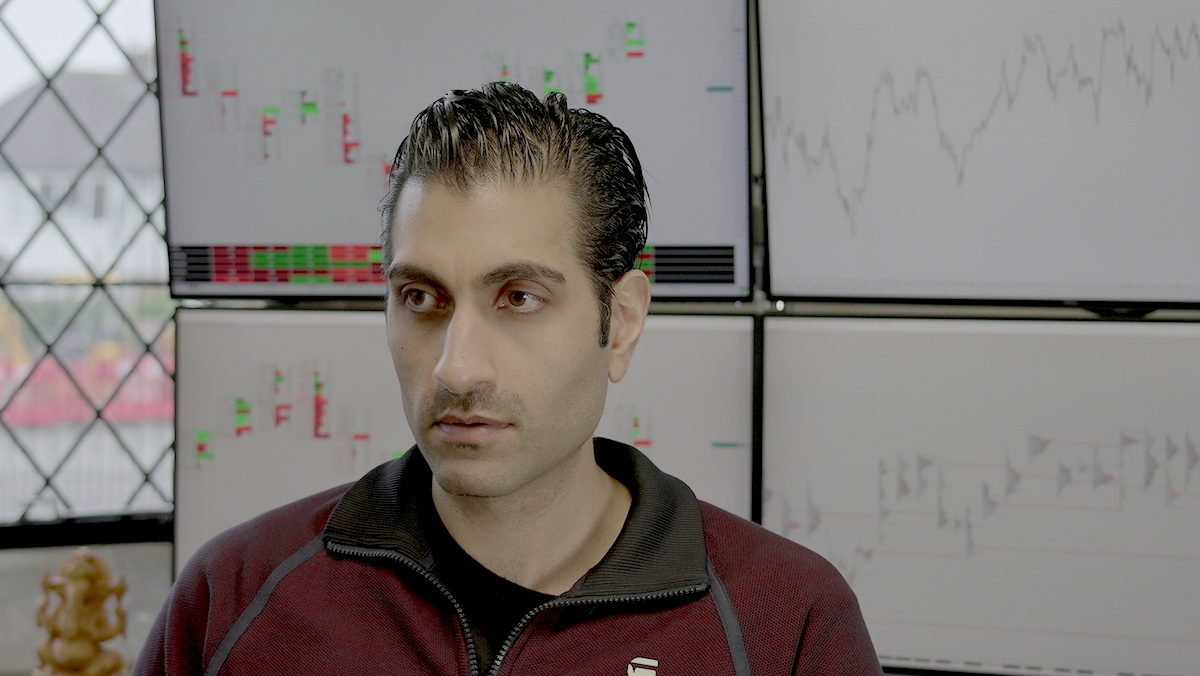

Neerav Vadera, a former trader at Barclays Investment Bank, has recently created the new G7FX trading programme that aims to disrupt the business with market-leading knowledge.

Because of the highly complicated and nuanced nature of global investing, it takes a long time for a trader to develop the abilities and insights necessary to make sound trading judgments. In the past, Forex trading was a popular way for people to earn money quickly. However, a lot of these traders were not experienced and were only trying to make a quick profit. Today, this is not the case. Forex traders have to be educated on the risks that they are taking when they trade in order to succeed.

Forex markets today

Forex markets are a global hub for trading, as they account for the majority of all of the world’s currency trading volume.

The forex market is dominated by institutional investors. Institutions represent a significant percentage of trade volume. They make up about 75% of all trades and in terms of value, it’s even larger – private investors account for a much smaller share of the marketplace.

Institutions contribute significantly to the liquidity of forex markets: they trade more than individuals, which means that they are responsible for a greater share of volumes traded. And because institutions don’t take large positions on one side or another (i.e., “hedge”), their trades have less impact on prices than individual traders’ ones have.

Risk taking for inexperienced traders

Forex traders who are trying to avoid risks should be aware of the risks that they take. For example, they should know the difference between margin and leverage and how it is applied to their trading activity.

Many new traders find it challenging to make strategic decisions from an outsider’s perspective because investments might carry a significant risk for people who are not tactically trained.

Following a successful career in the institutional sector, Neerav Vadera decided it was time to share his knowledge with traders all around the world by offering two separate programmes tailored to their specific needs. This would help them avoid the risks in the complex trading arena, while educating them on the markets.

“It’s no secret that trading can be challenging. It’s difficult to even get a foot in the door, let alone succeed. That isn’t to say it’s impossible; it just means you’ll need the necessary talents and education. You’ll be on your way to success once you’ve figured out how to navigate the market and use it to your advantage. “All you need to know is how to do it,” Neerav says.

How G7FX seeks to help Forex traders get ahead

G7FX is divided into two unique programmes to assist traders in fine-tuning their investing and market awareness.

The first is a foundation course that includes a comprehensive collection of content that includes over 13 hours of video. There are extensive business plans and timetables, as well as case studies of various institutions and how trading techniques might be adapted to the present financial situation.

As traders gain a better understanding of the fundamentals and dynamics of global trading, they can enrol in a more extensive pro course, where they can study some of the most cutting-edge investment ideas from Neerav Vadera’s career and personal experience as a trader. Advanced trading tactics, as well as a shift away from DOMs and toward charts and the more complicated footprint chart, are among them. The training also covers volume traffic as well as taking the VWAP into consideration for experienced traders.

The Neerav Vadera philosophy in action

Technical analysis is not used by some of the most profitable institutions, according to Vadera who developed the G7FX trading platform with this in mind. The logic behind this is debatable, as it is dependent on specialised trading tactics used in the institutional investing arena.

Neerav points out the weaknesses in the well known “Fibonacci Strategy,” which he claims is incorrectly utilised to predict future market moves. This form of analysis, which is extensively used, is particularly problematic and should be replaced with orderflow, which is a far more significant component for traders to examine because it provides a much more accurate picture of institutional positioning.

Having spent a considerable number of years in the corporate banking sector, Vadera has also taken the approach that work should be more balanced, and is one of the reasons he decided to fine tune a course but on his knowledge while becoming a private trader himself.

“We controlled around 10% of the worldwide foreign currency market ($3-5 trillion) during my time on the desk there. After that, I worked for some of the world’s most prestigious proprietary trading firms.

“I’ve been a continuously profitable private trader covering various markets since leaving the City. Working from my home office is now a pleasure for me. Trading has allowed me to provide for myself and my family while also allowing me to make the life choices I desire. I’m incredibly proud and appreciative for this! I’d like to share the information I’ve gained through G7FX with everyone.”

Challenges for future Forex traders

New traders are finding themselves in a fast-paced investment landscape as trading undergoes a fundamental transformation. With massive structural shifts taking place in the world of finance and trading as a whole, a new generation of traders is recognising the benefits of remote working and part-time jobs.

Numerous events can quickly impair or benefit a trader’s position in the increasingly complex and integrated financial landscape, but it’s not always possible to predict or notice when dangers are developing inside a certain market. And there’s never been a better moment for people to learn new skills online, or even choose a different job, as G7FX Trading positions itself to help traders and future traders find investing opportunities throughout the world.

Have you considered a career in Forex trading? What has been your perspective of online trading so far?

In partnership with G7FX

Financial disclaimer: Financial trading, and the use of leveraged products is extremely risky & can result in losses that exceed your initial deposit. Suitable advice should be obtained before commencing trading in the financial markets.